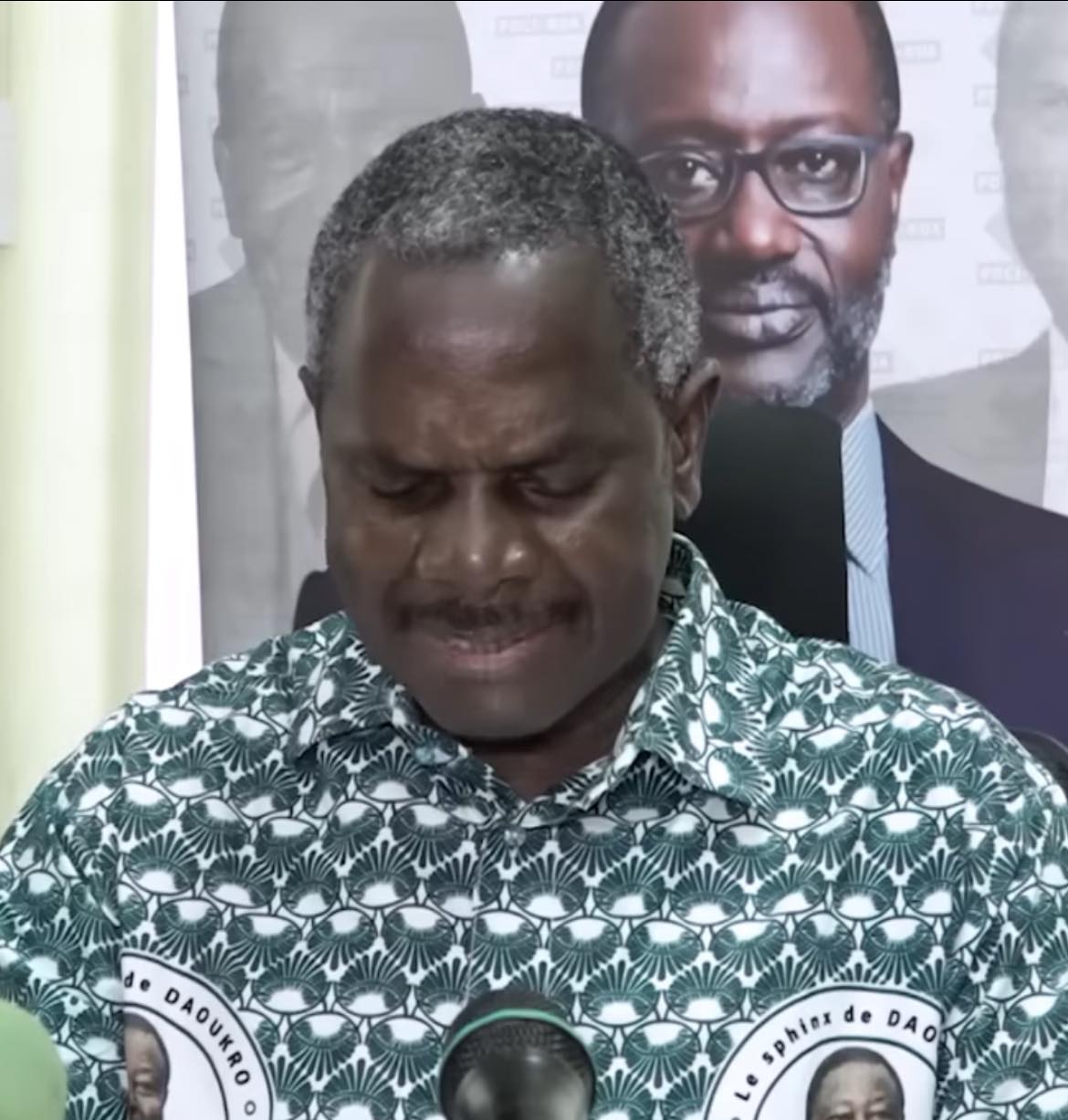

Tidjane Thiam – Credit Suisse : « Je suis fier que rien de tout cela ne se soit produit sous ma surveillance »

Interrogé par nos confrères du Financial Times, l’ancien banquier franco-ivoirien a défendu son bilan (2015-2020) au sein de la banque helvète, dont le cours de l’action a atteint son plus bas depuis trente ans.

C’est peu dire que le numéro deux bancaire suisse est empêtré dans une série de difficultés. Son action se traite à un plus bas historique, à 2,667 francs suisses, alors que la banque a annoncé il y a quelques semaines une restructuration radicale, et cherche à lever 4 milliards de francs suisses (4,03 milliards d’euros) pour renforcer ses finances.

Interrogé le 30 novembre lors d’une conférence organisée par le quotidien britannique Financial Times, l’ancien directeur général de Credit Suisse, Tidjane Thiam, a défendu son bilan au sein de l’institution, malgré la succession de crises qui ont frappé la banque depuis son départ.

À commencer par son départ lui-même.

(…)

Former Credit Suisse chief Tidjane Thiam defends his record Tidjane Thiam during his time as Credit Suisse CEO

Tidjane Thiam called for a cultural change during his tenure as Credit Suisse CEO. Keystone/ennio Leanza

Former Credit Suisse chief executive Tidjane Thiam has defended his record at the Swiss lender despite the litany of crises that have hammered the bank since his departure.

This content was published on November 30, 2022 – 09:45November 30, 2022 – 09:45

Owen Walker and Stephen Morris, Financial Times

Shares in the group hit a 30-year low on Tuesday morning, extending their decline to more than 35% since the bank announced a radical restructuring and CHF4 billion ($4.2 billion) capital raise last month.

A year after Thiam left Credit Suisse in 2020 following a damaging corporate espionage scandal, the bank was forced to close $10 billion of supply chain finance funds linked to the defunct company Greensill Capital. It was also hit with a $5.5 billion trading loss — the biggest in its 166-year history — tied to the implosion of family office Archegos.

Thiam ‘proud’ of his record as he departs Credit Suisse

This content was published on Feb 13, 2020Feb 13, 2020 Tidjane Thiam reports solid financial results on his last day in office following a damaging Credit Suisse spying scandal.

“I was extremely tough and I’m quite proud that none of that happened under my watch,” said Thiam, speaking at the Financial Times’ Banking Summit on Tuesday, one of the first times he has talked publicly about his turbulent five years at the top of Credit Suisse.

Risk culture

The bank’s lax culture of risk management has frequently been blamed for its failings — including by former and current chairs António Horta-Osório and Axel Lehmann.

But the 60-year-old insisted he had identified this as a problem and tried to address it, pointing to his comments in 2016, his second year in charge, when he called for a “cultural change” at the bank after it wrote down hundreds of millions on its distressed debt holdings, which he claimed traders hid from him.

At the time he said: “I’m confident that we have good processes in place to try and ensure that this never happens again . . . [but] I can never say never.”

“Cultural issues can’t be resolved overnight,” said Thiam. “We did what we did during five years. But [it takes] more than five years to reach that point.

“It will take a lot of continued effort to deal with those issues.”

Racism row

In a wide-ranging interview, Thiam gave his views on topics ranging from the racist treatment he felt he received in Switzerland to the “good value” to be found at present by investing in the Spac market.

Thiam was the first black chief executive of a leading European bank and Credit Sisse’s largest shareholder, Harris Associates, has claimed he was a victim of racism.

Credit Suisse cuts thousands of jobs to restore fortunes

This content was published on Oct 27, 2022Oct 27, 2022 Credit Suisse selling off large chunks of its business and raising billions in extra capital from Saudi Arabia.

The bank apologised to Thiam in 2020 following a report in the New York Times that included details of a party to celebrate former chair Urs Rohner’s birthday where Thiam was present and a black performer dressed up as a janitor and other guests wore Afro wigs.

“People who are prejudiced say, oh he is playing the race card,” said Thiam at the Banking Summit. “Certain segments of the German-speaking press in Zurich . . . waged a very toxic and very effective campaign against me.”

Since leaving Credit Suisse, Thiam has focused on a range of interests, including setting up a Spac, taking advantage of a boom in the market that has since imploded amid accusations that it offers poor returns for investors.

He defended the blank-cheque investment vehicle, saying they offered good value to investors. “Terms are being renegotiated and I think that people who are going into Spacs now will make good money,” he said.

Asked about his thoughts on Credit Suisse’s share price, Thiam said he was saddened by the bank’s current plight and felt “no schadenfreude”.

Copyright The Financial Times Limited 2022

Commentaires Facebook